Make your own deficit-reduction plan

- Read more about Make your own deficit-reduction plan

- Log in or register to post comments

Since we're already on the subject.

If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks … will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered … The issuing power should be taken from the banks and restored to the people, to whom it properly belongs. Thomas Jefferson

If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks … will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered … The issuing power should be taken from the banks and restored to the people, to whom it properly belongs. Thomas Jefferson

I believe that banking institutions are more dangerous to our liberties than standing armies. Thomas Jefferson

The modern theory of the perpetuation of debt has drenched the earth with blood, and crushed its inhabitants under burdens ever accumulating. Thomas Jefferson

I wish it were possible to obtain a single amendment to our Constitution. I would be willing to depend on that alone for the reduction of the administration of our government to the genuine principles of its constitution; I mean an additional article, taking from the federal government the power to borrow money. Thomas Jefferson

If (As the supreme court had recently inferred) Congress has the right under the Constitution to issue paper money, it was given to them to be used by themselves, not to be delegated to individuals or corporations. Andrew Jackson

The Government should create, issue, and circulate all the currency and credits needed to satisfy the spending power of the Government and the buying power of consumers. By the adoption of these principles, the taxpayers will be saved immense sums of interest. Money will cease to be master and become the servant of humanity. Abraham Lincoln

Yes you did you half-witted narcissistic twit!!!!!

"We can not and will not sustain deficits like these without end.

"We can not and will not sustain deficits like these without end.

Contrary to the prevailing wisdom in Washington these past few years, we can not simply spend as we please and defer the consequences to the next budget, the next administration or the next generation.

We are paying the price for these deficits right now.

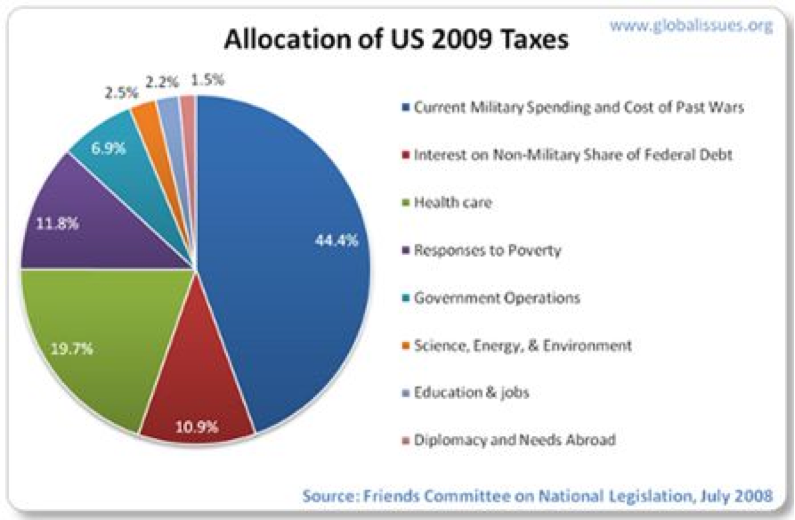

In 2008 alone we paid $250 billion in interest on our debt, that is more than three times what we spent on education that year, more than seven times what we spent on VA healthcare.

So if we confront this crisis without also confronting the deficits that helped cause it, we risk sinking into another crisis down the road as our interest payments rise, our obligations come due, confidence in our economy erodes and our children and grandchildren are unable to pursue their dreams because they are saddled with our debts.

That's why today I am pledging to cut the deficit we inherited by half by the end of my first term in office.

This will not be easy - it will require us to make difficult decisions and face challenges we have long neglected but i refuse to leave our children with a debt they can not repay.

And that means taking responsibility right now in this administration, for getting our spending under control."

He's better get off his boney butt and get it in gear if he expects to make this one ... that's the joke you see, he never expected to make this one.

Overpaid unemployment benefits top $14 billion

NEW YORK (CNNMoney) -- Don't spend that unemployment check too fast. The government might ask you to pay it back.

Overpayments are a rampant problem in the unemployment insurance system. The federal government and states overpaid an estimated $14 billion in benefits in fiscal 2011, or roughly 11% of all the jobless benefits paid out.

Of the states, Indiana was the worst offender, making more improper payments than it did correct ones.

Now, the U.S. Department of Labor and the states are in the midst of a massive effort to try to recoup some of their lost funds and avoid future overpayments.

The vast majority of unemployment benefits do go to people in need. In 2010 alone they helped keep 3.2 million Americans out of poverty, according to the Census Bureau.

But of the overpaid funds, most end up in the hands of three types of people: Those who aren't actively searching for a job, those who were fired or quit voluntarily, and those who continue to file claims even though they've returned to work. Any of those circumstances would make a person ineligible for benefits.

The overpayment typically results from an administrative error made either by the government, the employer, the worker or a combination of the three. ...

... In fiscal 2011, there were roughly 2,700 convictions for fraud related to unemployment insurance.

Or roughly 2,700 more convictions than were effected for fraud related to the mortgage debacle and the financial crisis.

From  Bloomberg via Zero Hedge

Bloomberg via Zero Hedge here's just one more example of the pervasive collusion between our government the banks and in this case the seemingly ubiquitous J.P. Morgan.

here's just one more example of the pervasive collusion between our government the banks and in this case the seemingly ubiquitous J.P. Morgan.

Click on the photo of Mr. Dimon below for the entire story.

Among the real good questions you didn't hear from anyone in Congress during the Jamie Dimon festival of love recently held on Capital Hill.

Dear Mr. Dimon, Is Your Bank Getting Corporate Welfare?

When JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon testifies in the U.S. House today, he will present himself as a champion of free-market capitalism in opposition to an overweening government. His position would be more convincing if his bank weren’t such a beneficiary of corporate welfare.

To be precise, JPMorgan receives a government subsidy worth about $14 billion a year, according to research published by the International Monetary Fund and our own analysis of bank balance sheets. The money helps the bank pay big salaries and bonuses. More important, it distorts markets, fueling crises such as the recent subprime-lending disaster and the sovereign-debt debacle that is now threatening to destroy the euro and sink the global economy.

How can all this be? Let’s take it step by step.

We first posted this video in June of 2010.

Seemingly nothing has changed.

We've done some variations on the following issue a number of times now.

We believe it to be worth repeating.

To quote President Dwight D. Eisenhower one more time.

The following is taken from  Zero Hedge.

Zero Hedge.

With apologies to Tyler Durden, I took for all practical purposes the entire post as I couldn't figure a way to abbreviate it and still suck you into clicking through to read it all.

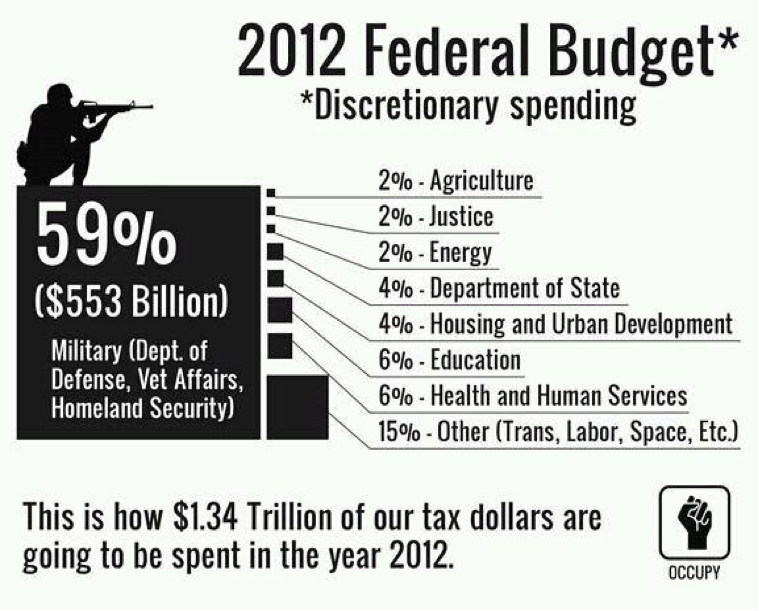

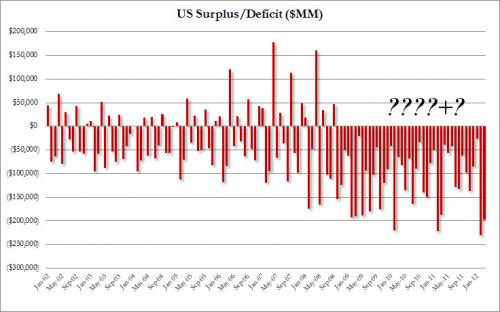

Following the all time record high February budget deficit of $232 billion, the US March budget deficit number is in, and in addition to being bigger than expected, coming at $198.2 billion on expectations of "only" $196 billion, the government outlay in the past month also is the largest March deficit on record.

of $232 billion, the US March budget deficit number is in, and in addition to being bigger than expected, coming at $198.2 billion on expectations of "only" $196 billion, the government outlay in the past month also is the largest March deficit on record.

This brings the total deficit in fiscal 2012 to $779 billion, which is to be expected for a country gripped in total political chaos and which is unable to either raise revenues or lower spending.

What is more disturbing is that over the same period (Oct 1 2011 - March 31, 2012), the US government issued $792 billion in debt, a trend that will continue.

What is most disturbing is that the comparable tax revenues net of refunds, "matching" this increase in deficit and spending, are only $693 billion, in other words the US government is funding well more than half of its cash needs with debt rather than with tax revenue.

The chart below speaks for itself ...

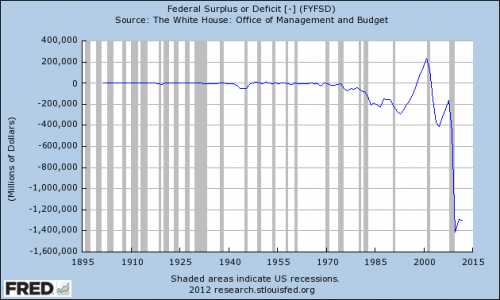

... as does the long term chart.

Now, from Learn Liberty.org who typically do a very nice job of explaining economic issues in terms most civilians can easily understand, a two minute vid boiling the conversation about the deficit down to terms practically anybody can grasp.

who typically do a very nice job of explaining economic issues in terms most civilians can easily understand, a two minute vid boiling the conversation about the deficit down to terms practically anybody can grasp.

Followed by an incomplete (IMHO) conversation having to do with the historical fact that over the past 50 years, massive changes to the tax rate and code have made very little difference in the government's total take as a percentage of GDP.

That which the left seemingly finds impossible to grasp is the notion that people make decisions about work and money and subsequently change their behavior in response to the tax code.

Raising capital gain rates influences some people to hold assets who would otherwise be sellers.

Reduced sales of financial assets yields a reduction in federal tax receipts as assets become locked in place while dampening economic activity as new endeavors find it more difficult to obtain capital.

Raising marginal rates on labor causes some people to work less as work becomes financially less worth the extra effort.

Fewer hours yields lower incomes along with reduced income and payroll taxes.

Which is why lower tax rates and a simplified tax code will always inspires economic growth and subsequently provide enhanced funding for government.