Two differing approaches

Taken from China Daily 1/28/2010

“

“China Investment Corp. increased spending on energy and minerals assets last year to profit as the global economy recovers. The Beijing-based fund avoided the worst of the credit crunch in its first full year in 2008 and may have had a return of more than 10 percent in 2009, said London-based Jan Randolph, director of sovereign risk, analysis and forecasting at IHS Global Insight. ‘They have timed the upside well both in market terms, but also to fit in with the longer-term diversification strategy,’

“CIC has had ‘early’ talks for direct investments in

“With China’s reserves at $2.4 trillion and swelling by an average of $37.8 billion a month last year, CIC has asked the government for another $200 billion…” China Daily 01/28/2010

Taken from the fine site, "Seeking Alpha".

Click anywhere within the body of the paragraph for the complete article.

Another site that I highly recommend for grownup reading.

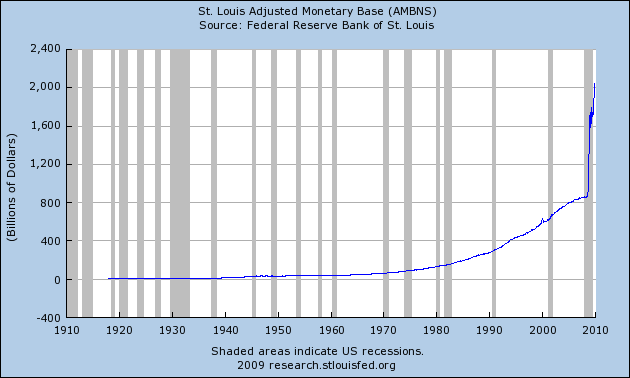

Steven Gross, the Chief Actuary of the Social Security Trust fund wrote a letter* on 9/15/2008. In that letter he included this graph.

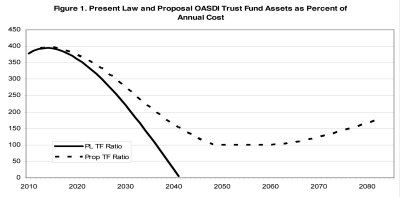

On 2/12/2009 Mr. Gross wrote a letter* to Senator Robert Bennet. That letter contained this graph.

- Read more about Two differing approaches

- Log in or register to post comments

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)