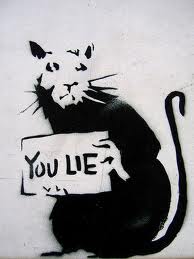

To quote Richard Russell, once again

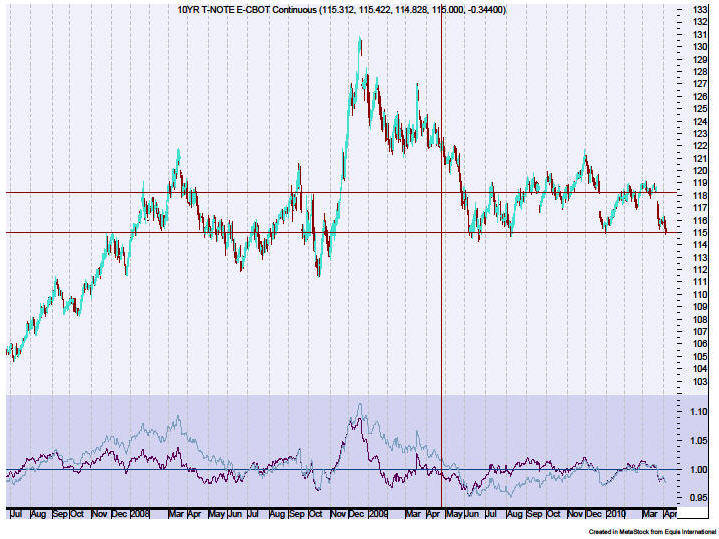

If the March 2009 was a bear market low, it was unlike any bear market low that I have ever seen.

Where were the "great values" that always present themselves at a bear market bottom?

Where were the juicy Dow dividend yields that we invariably see at true bear market bottoms.

For instance, back in 1981 the Dow dividend yield was 6.42%.

At the bear market low of 1974 the Dow dividend yield was 6.12%.

In 1940 the Dow dividend was 6.84%.

In the dark year 1931, the Dow dividend yield was 10.78%

Where were the fabulous values in March 2009?

The answer, March 2009 was not a true bear market bottom.

The next great bear market low lies ahead!"

- Read more about To quote Richard Russell, once again

- Log in or register to post comments

.jpg)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)