To quote Thomas Wood

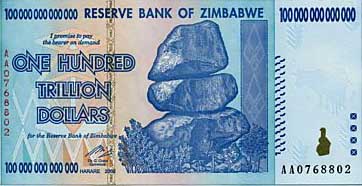

Thomas Wood, author of ![]() "Meltdown" provides the clearest explanation I've read of the events that caused the various "bubbles" we have endured over the past 10 years.

"Meltdown" provides the clearest explanation I've read of the events that caused the various "bubbles" we have endured over the past 10 years.

"Asset bubbles, like the housing bubble we’ve just lived through, do not occur spontaneously. If people bought lots of houses on the free market, interest rates would rise as the banks’ loanable funds were depleted. That would put an end to speculation in real estate.

But thanks to the Federal Reserve System (or simply the 'Fed'), which is no part of the free market, large infusions of money created out of thin air kept interest rates low, and thus perpetuated the bubble. During an asset bubble, demand for the asset in question rises, as does its price. Where would people get the money to keep buying an increasingly costly asset if the government’s officially approved money machine weren’t there to flood the economy with cash?

It was this interference with interest rates, pushing them well below where the free market would have set them, that set in motion the classic boom-bust cycle we’ve just witnessed. F.A. Hayek won the Nobel Prize for showing how central banks like the Federal Reserve, by interfering with interest rates and not allowing them to tell entrepreneurs the truth about economic conditions, divert the economy into unsustainable configurations that inevitably come undone in a crash. (Hayek belongs to a tradition of free-market thought called the

Adding fuel to the fire was the so-called Greenspan put, the unofficial policy of the Greenspan Fed that promised assistance to private firms in the event of risky investments gone bad. What kind of incentives do you suppose that created?"

- Read more about To quote Thomas Wood

- Log in or register to post comments

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)