Who Destroyed The Middle Class?

The following quotes and charts were all taken from a Burning Platform post titled Who Destroyed the Middle Class? - Part 1.

post titled Who Destroyed the Middle Class? - Part 1.

You should read it as it's probably your ass that's getting chewed off here.

As always, click on any of the charts for a link to this outstanding piece.

“Over the last thirty years, the United States has been taken over by an amoral financial oligarchy, and the American dream of opportunity, education, and upward mobility is now largely confined to the top few percent of the population. Federal policy is increasingly dictated by the wealthy, by the financial sector, and by powerful (though sometimes badly mismanaged) industries such as telecommunications, health care, automobiles, and energy. These policies are implemented and praised by these groups’ willing servants, namely the increasingly bought-and-paid-for leadership of America’s political parties, academia, and lobbying industry.” – Charles Ferguson – Predator Nation

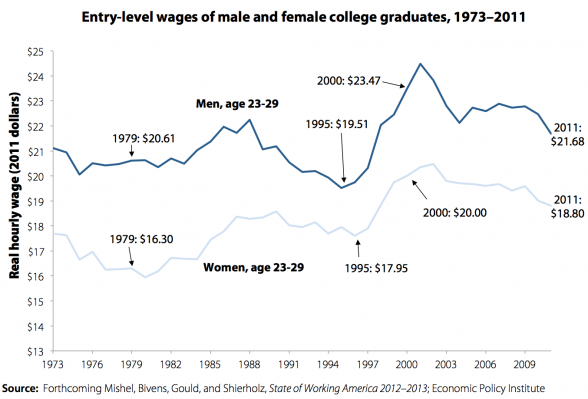

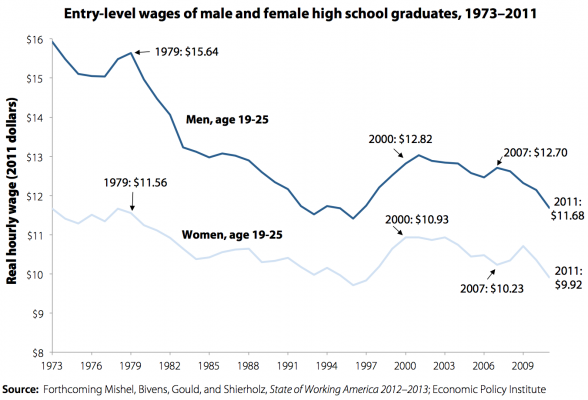

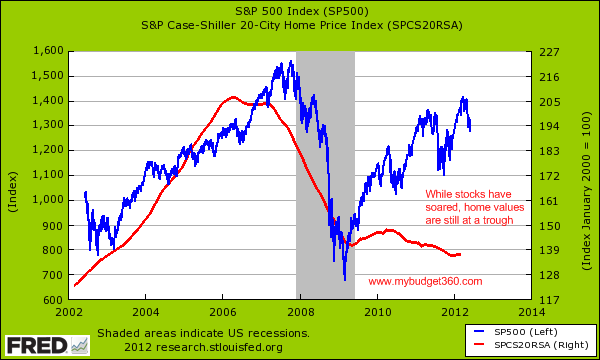

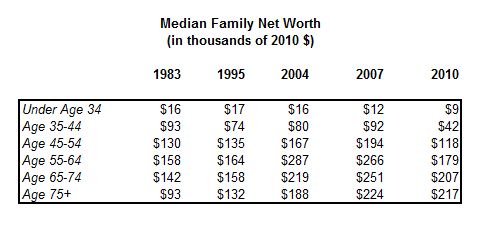

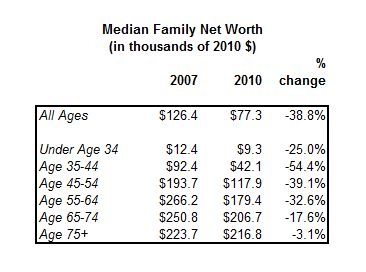

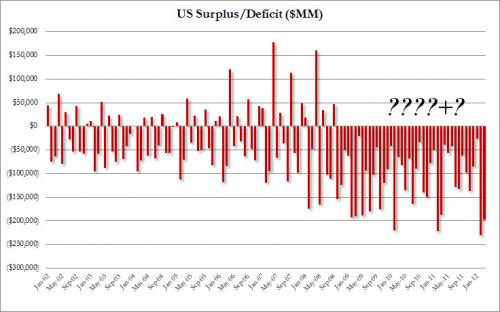

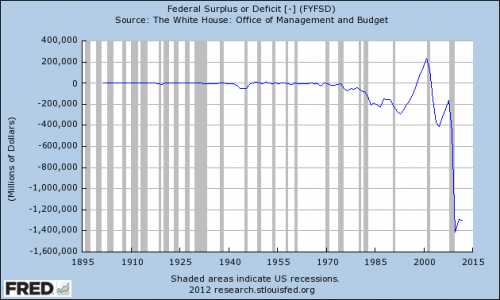

The Federal Reserve released its Survey of Consumer Finances last week. It’s a fact filled 80 page report they issue every three years to provide a financial snapshot of American households. As you can see from the chart above, the impact of the worldwide financial collapse has been catastrophic to most of the households in the U.S. A 39% decline in median net worth over a three year time frame is almost incomprehensible. Even worse, the decline has surely continued for the average American household through 2012 as home prices have continued to fall. Median family income plunged by 7.7% over a three year time frame and has not recovered since the collection of this data 18 months ago. Even more shocking is the fact that median household income was $48,900 in 2001. Families are making 6.3% less today than they were a decade ago. These figures are adjusted for inflation using the BLS massaged CPI figures. Anyone not under the influence of psychotic drugs or engaged as a paid shill for the financial oligarchy knows that inflation is purposely under reported in order to keep the masses sedated and pacified. The real decline in median household income is in excess of 20% since 2001.

Start shopping for your pitchfork, get yourself a real pointy one.

- Read more about Who Destroyed The Middle Class?

- Log in or register to post comments

We've run a number of interviews with law professor and former federal government banking regulator Bill Black who has become one of our personal heroes having put a no kidding thousands of bankers in jail during the Savings and Loan fiasco.

We've run a number of interviews with law professor and former federal government banking regulator Bill Black who has become one of our personal heroes having put a no kidding thousands of bankers in jail during the Savings and Loan fiasco.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)