International Misery Index

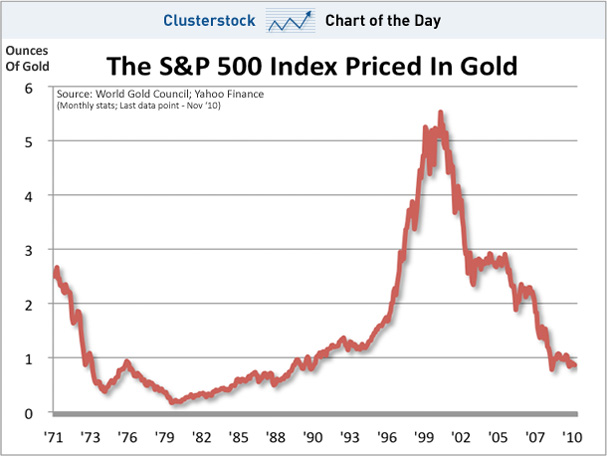

From ![]() Bryan Rich at Money and Markets

Bryan Rich at Money and Markets![]() via

via ![]() R.E. McMaster.

R.E. McMaster.

Click the chart below for the entire article.

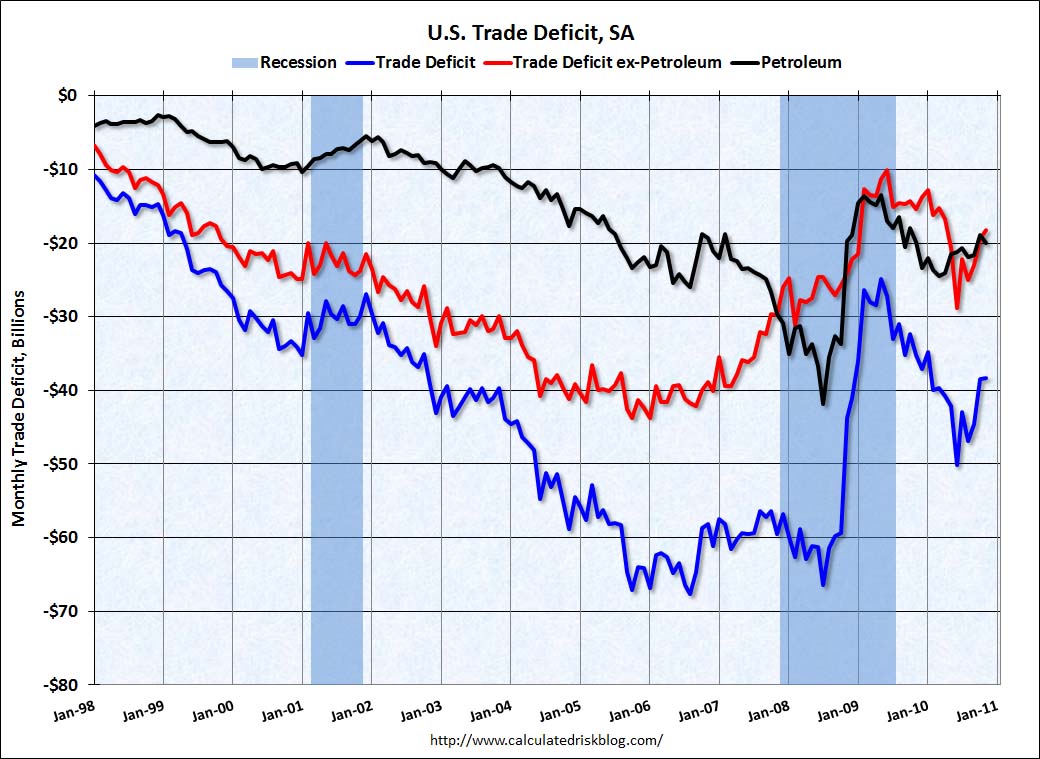

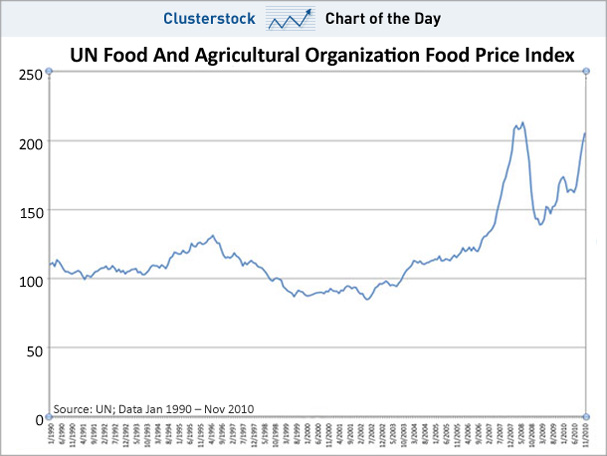

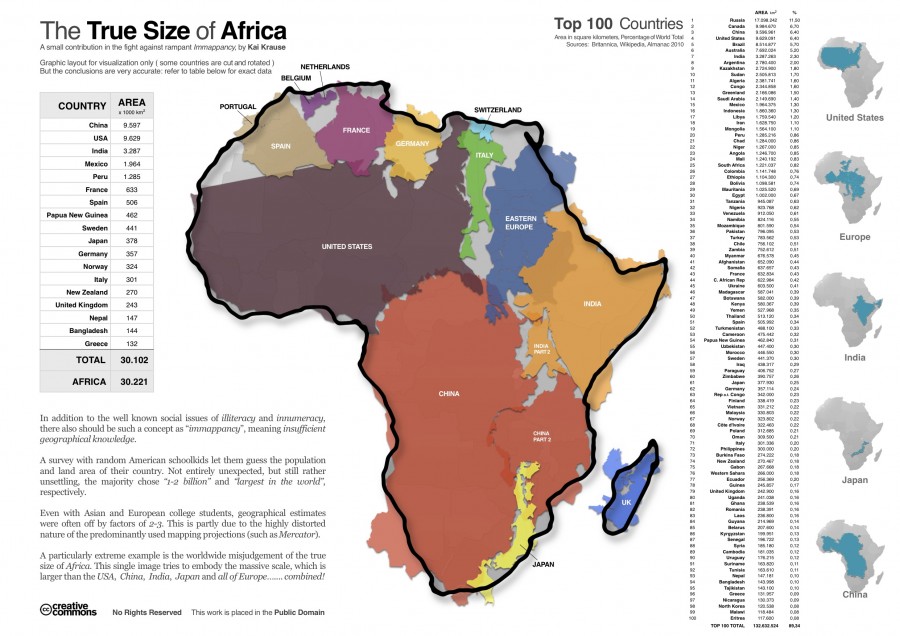

This dangerous combination of persistent unemployment and rapidly rising food inflation isn’t just specific to North Africa and the Middle East. Global unemployment remains at record levels. And world food prices rose to a record in January.

The expanding unrest is most vulnerable in those countries with low per capita income, where people may spend as much as 70 percent of their income on food. Moreover, the threat of civil disorder rises when those countries have significant income inequality and/or have gone through major economic stress where the outlook for a return to normalcy looks bleak.

In this environment, there are many countries that fit the bill. Take a look at how risks in other parts of the world stack up against Egypt and Tunisia.

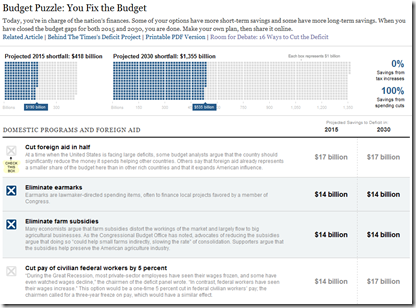

The table below is a gauge of economic misery across the biggest countries in the world. This index was created by a former economic advisor to President Lyndon Johnson, Arthur Okun. It simply takes the sum of inflation and unemployment rates. According to his index, the higher the index value the more miserable life is in these countries.

The US is at 11% only if you believe that inflation statistics shouldn't include food and fuel.

- Read more about International Misery Index

- Log in or register to post comments

.jpg)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)