The Shiller P/E Ratio

![]() Professor Robert Shiller (Yale) is probably best known for his book "Irrational Exuberance"

Professor Robert Shiller (Yale) is probably best known for his book "Irrational Exuberance"![]() and the "Case-Shiller US Home Price Index he developed with Professor Karl Case (Wellesley) .

and the "Case-Shiller US Home Price Index he developed with Professor Karl Case (Wellesley) .

In his spare time, he came up with the Shiller P/E ratio.

The Shiller P/E ratio is calculated as follows: divide the S&P 500 by the average inflation-adjusted earnings from the previous 10 years.

Got that?

Don't worry about it.

Up is good if you're selling stocks.

Down is good when you're buying.

The chart below was taken from an article at The Daily Reckoning![]() written by

written by ![]() Dan Amoss having to do with a speech given March 24, 2010 by Russell Napier of CLSA (no clue) at the CFA Society (Certified Financial Analyst).

Dan Amoss having to do with a speech given March 24, 2010 by Russell Napier of CLSA (no clue) at the CFA Society (Certified Financial Analyst).

Excerpts from this most quotable speech, one of which I've posted below, are all over the place.

Recommended.

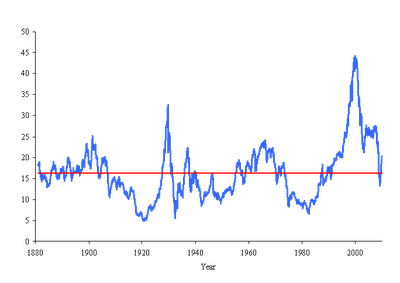

The following chart from The Seeker Blog![]() shows the same chart with it's historic average in red.

shows the same chart with it's historic average in red.

- Read more about The Shiller P/E Ratio

- Log in or register to post comments

.jpg)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)