Arlen Specter

- Read more about Arlen Specter

- Log in or register to post comments

The US Mint is suspended its production of 1 oz. gold eagle and gold buffalo coins three times in 2009

Over the last decade the DJIA is down about 80% against gold.

The following is from John Hathaway at Tocqueville Asset Management 11/30/2009

Click anywhere below to link up to the entire piece.

This quantity adds a puny 1% or 2% to the above ground supply of 163,000 or so metric tonnes.

Therefore, traditional supply and demand analysis does little to explain price movement.

It is better to think of gold as a multi trillion dollar capital market asset.

In theory, all of it is potentially for sale at any given time.

To speak of a rising gold price is technically incorrect.

Gold per se does not excite the investment world. It has not suddenly changed its stripes.

What has changed is the world around it.

“In our opinion, the investment rationale for gold, in today’s circumstances, is deflation.

The post World War II economic model of economic growth based on secular credit expansion is broken.

We believe the applicable model is a 1930’s style credit deflation.

Asset prices are pressured by deleveraging.

Uncertainty as to collateral values restricts credit despite available liquidity.

A negative shift in expectations rapidly overtakes behavior.

The Fed understands this and is acting accordingly.

This is pretty much where things stand at the moment.

It remains to be seen whether massive stimulus can offset the headwinds of a negative credit cycle.

“Zero interest rates are designed to encourage a new carry trade.

Free money is intended to inflate asset values in hopes of restarting the credit cycle.

In other words, our ‘leaders’ in Washington will solve the problem of too much debt with more debt.

Decades of credit excesses have brought us to the brink of a credit collapse.

Things should get really interesting for gold when government actions are seen to be impotent.

If currencies are successfully debased through inflation, gold will retain its value.

Gold is a hedge against a world monetary order on its death bed.”

John Hathaway, Tocqueville Asset Management L.P., 11-30-09

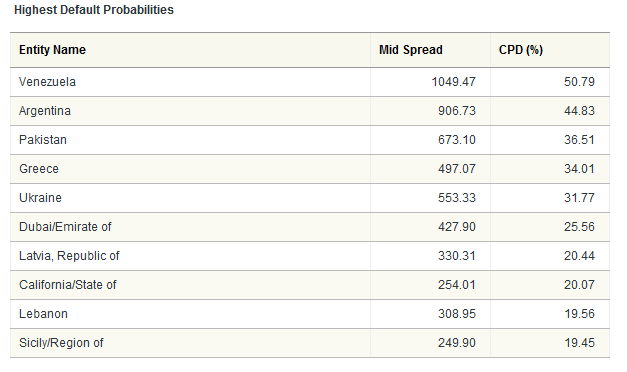

Joining Venezuela, Argentina, and Greece among other notable bastions of fiscal responsibility, California sprints into the top ten list of likely international deadbeats with a very impressive 20% probability of default.

Can Sam be far behind?

Not a chance!!!!!

Owning your own printing press is a good thing ... for everyone but savers.

Here in southeastern Michigan, we always assume it only goes on in Detroit.

To be perfectly honest about it, we assume it always goes on in Detroit.

In our defense, we have beau coup evidence.

But ..... we couldn't be more wrong.

About it just going on in Detroit, we're not even a little bit wrong about it always going on in Detroit.

Here are two recent examples totaling just under $2,500,000 of fraud and theft by employees of the school district in which I happen to reside.

![]() Richard Zaranek a former

Richard Zaranek a former

Zaranek a resident of Grosse Pointe Farms Michigan, siphoned funds from Cherokee's latchkey program and Parent Teacher Organization partly by persuading parents to let him handle the money.

He created phony paperwork to account for the funds and left enough money in the programs to avoid suspicion.

Zaranek also took school property - a tractor, a lawn mower, gym equipment, mountain-climbing equipment, a computer and a puppet theater.

The lawn equipment was found at his cottage in Hillman, Michigan.

Other items were said to be found at his home and at his brother's residence.

![]() James Tague a former executive director of support services for Chippewa Valley Schools cheated Chippewa Valley Schools out of more than $2 million by inflating furniture bids through a company he secretly owned.

James Tague a former executive director of support services for Chippewa Valley Schools cheated Chippewa Valley Schools out of more than $2 million by inflating furniture bids through a company he secretly owned.

Tague pleaded guilty to charges of fraud.

The U.S. Attorney's Office said Tague worked out a scheme where companies he owned would bid on school furniture for the district and sell the merchandise at a huge profit to the school district.

The following trailer is for a movie that is likely to be ignored.

It needs to be seen ...... everywhere.

People in my community are attempting to bring it to town.

And since I now have a national readership.

That would be about one reader in each of the fifty states.

I'm reaching out and encouraging everybody to make a small effort toward bringing this film to your town.

The Cartel

http://www.thecartelmovie.com/

Dealers claim regional banks are stockpiling gold for clients who want their deposits saved in the yellow metal.

Emirate Business 24/7

by: Shahsank Shekhar May 05, 2010

Click the photo for the entire article

If it seems like I'm harping on this Gold thing, it's because I am.

Bill Bonner at the Daily Reckoning does a nice job here in analyzing the Greek debt crisis simply, and with the possible exception of a central banker or your garden variety EU bureaucrat, in language anybody can understand.

Click anywhere on the quote for the entire piece.

Recomended.

Greek communists are usually a reliable bastion of error and darkness.

I have a question:

How does all this massive amount of legislation, hundreds and hundreds if not thousands of pages, which common sense tells us takes months if not years to draft, magically appear overnight right after a crisis, like the Patriot Acts, Obamacare, and the new onerous financial regulations?

Gosh, a skeptic would think that such is crafted well ahead of time behind the scene.

Plus, no politician has or takes the time to read all this legislation.

The politicians blindly just vote.

Is it like the sheeple are being deliberated herded toward the slaughter works, a place that is clearly contrary to their own best interest long-term?

The Gaia, Mother Earth, New Age, collectivist philosophy of the ruling elite is that “humanity is dandruff that needs to be cleansed from the scalp of Mother Earth.”

The masses in Euroland, the US, the UK, Japan and China are starting to seriously question the legitimacy of their political leadership.

Such historically has preceded an economic and politically distracting war.

Historically, mankind gets into trouble when it buys into the earth-based collectivist philosophy as opposed to the Creator-based individualistic philosophy.

So, love your real mother this Mother’s Day!

The Powers That Be (PTB) are fast running out of slick rhetoric, empty promises, zero interest rates, and endless bailouts for their cronies.

Our concern should be that next comes inflation, more tyrannical controls, loss of freedom, and war.

Desperate men, addicted to power, do desperate things.