In 1977, Congress amended The Federal Reserve Act, stating the monetary policy objectives of the Federal Reserve to be as follows,

"The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates."

The notion that the Fed is tasked with promoting maximum employment and stable prices is what is frequently termed the Fed's "Dual Mandate".

Having failed miserably throughout the entirety of it's charter (1913) to maintain stable prices, as the decline in the value of the dollar equals increased prices for everything other than a dollar.

The purchasing power of the dollar 1792 - present, dotted lines signify those periods when convertability to gold was/is suspended.

The Fed decided this week that they better address their almost equal fail with regards to maintaining full employment, on account of the following.

Things are not going swimmingly in Detroit.

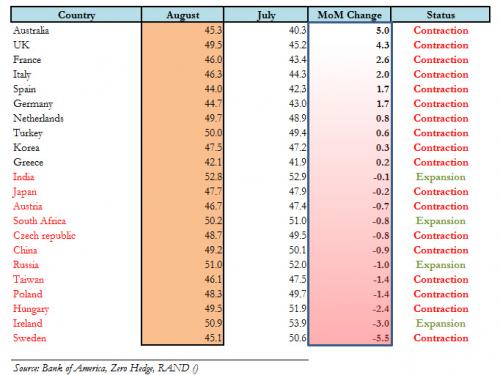

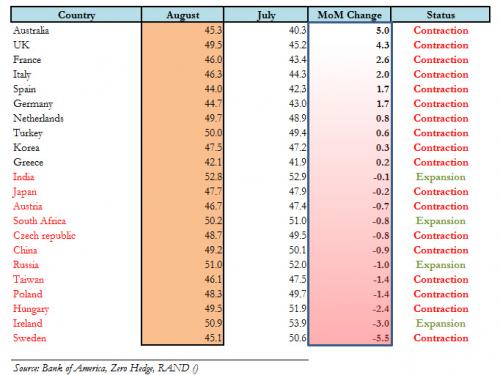

Purchasing managers all over the world are backing off ... numbers below fifty for the Purchasing Managers Index signify economic contraction.

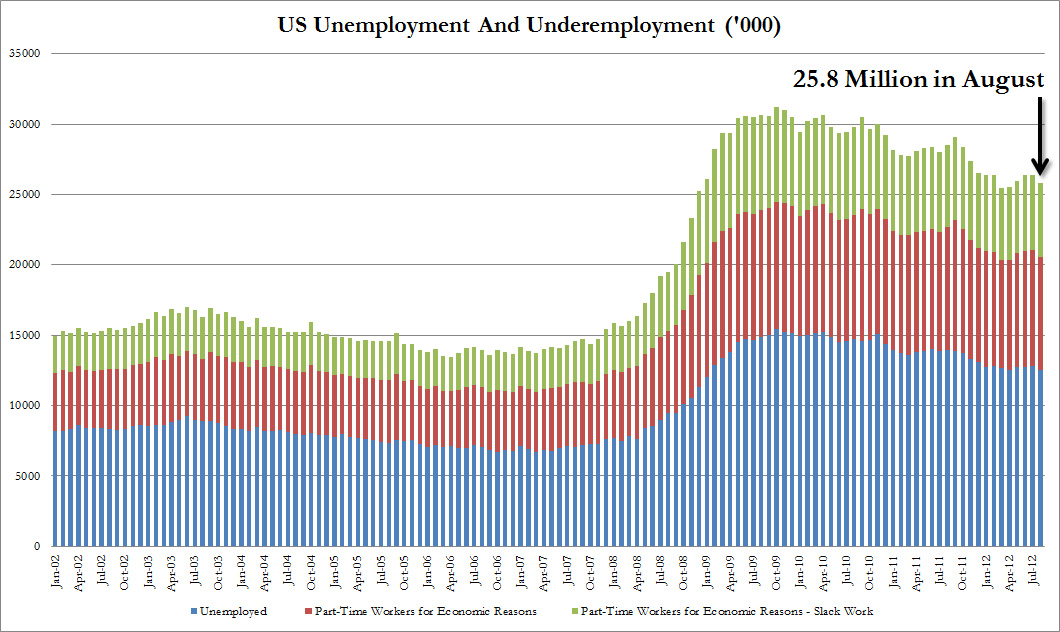

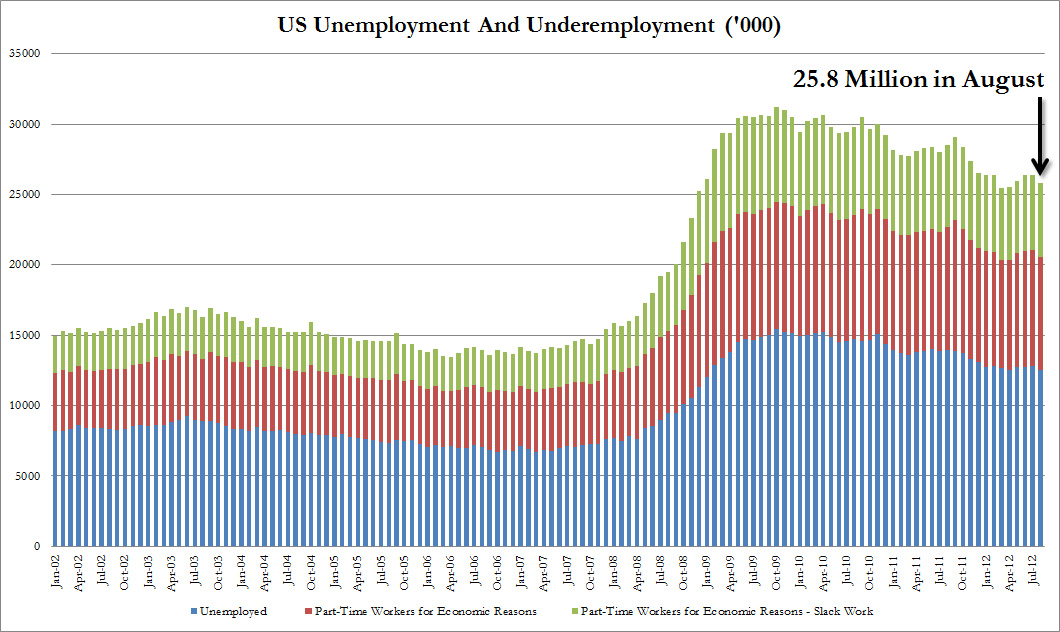

Here's where Clint Eastwood gets his number for unemployment.

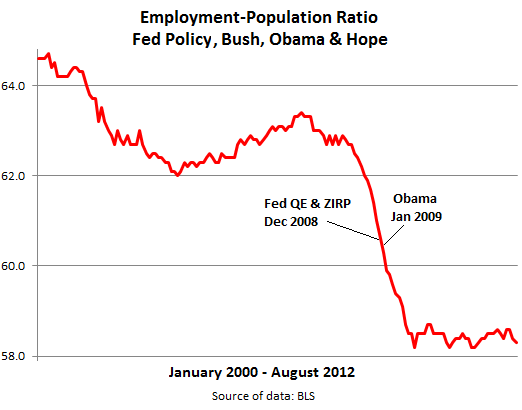

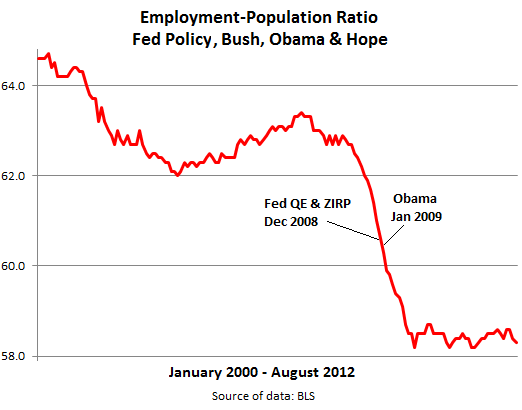

The employment to population ratio pretty much sucks.

Although it may be forming a bottom ..... one hopes.

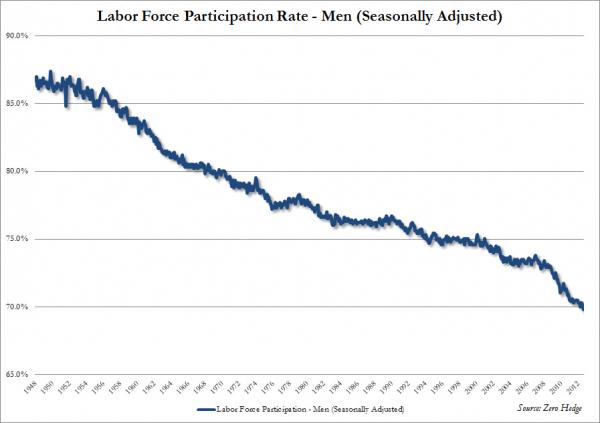

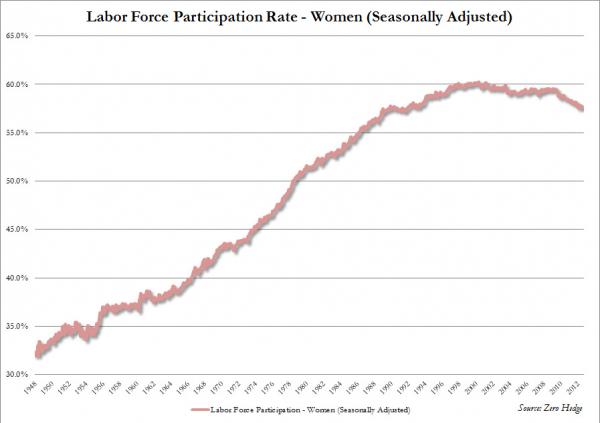

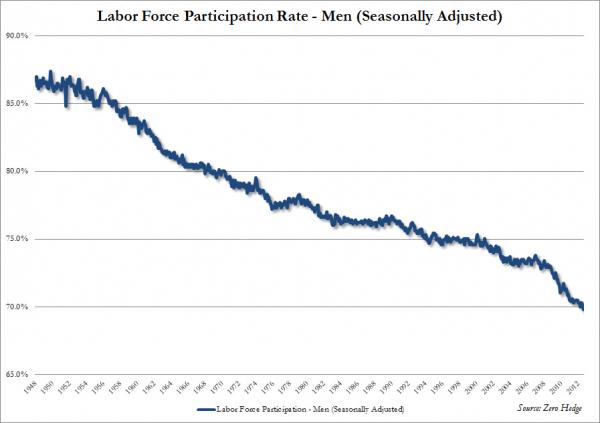

What's up with this?

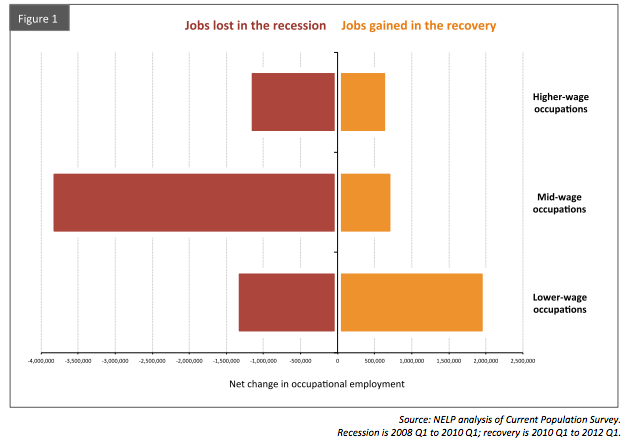

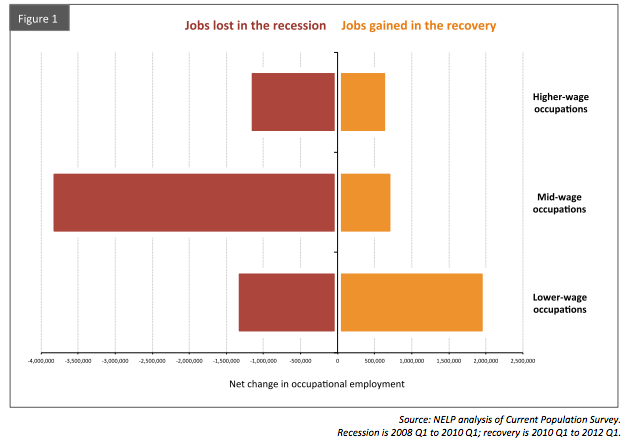

That's the new economy at work ..... so to speak.

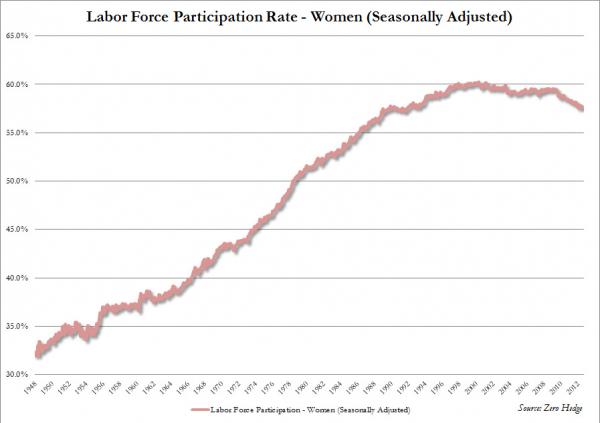

Service jobs are what we do around here now days.

1948 to the present.

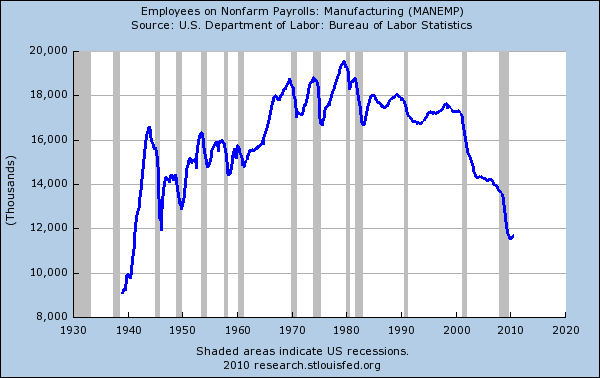

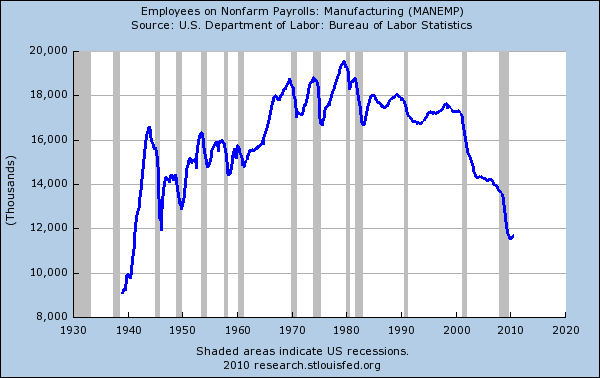

Dirty manufacturing is out of favor, construction is smashed.

Look closely here, these are total numbers not percentages.

Adjust this horror story for population growth and think it through.

In our opinion, you are looking at the single most profound unintended consequence of kneejerk green/liberal/progressive othodoxy of them all.

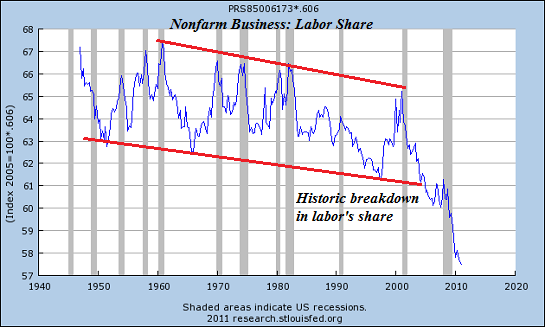

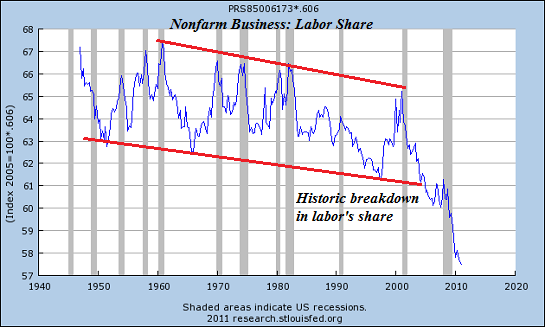

As a result, Labor's share of GDP is at historic lows as all those new bartender jobs just don't pay.

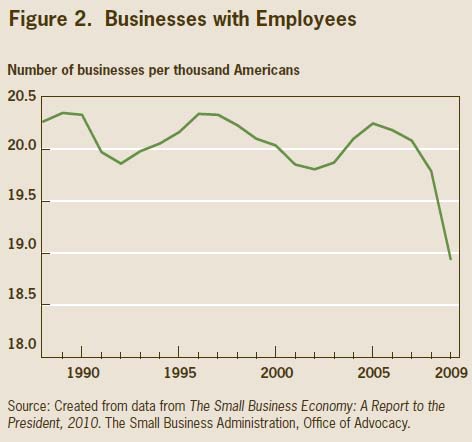

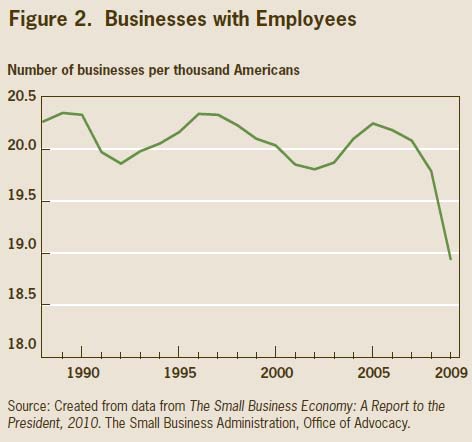

It gets worse if indeed small business is the engine of job creation.

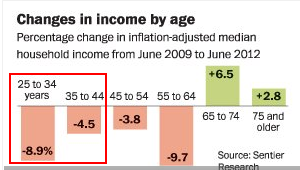

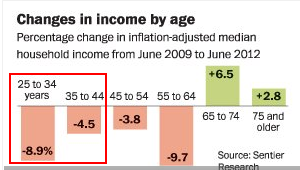

This next one suprised us as we would have guessed the suffering extended across all age groups.

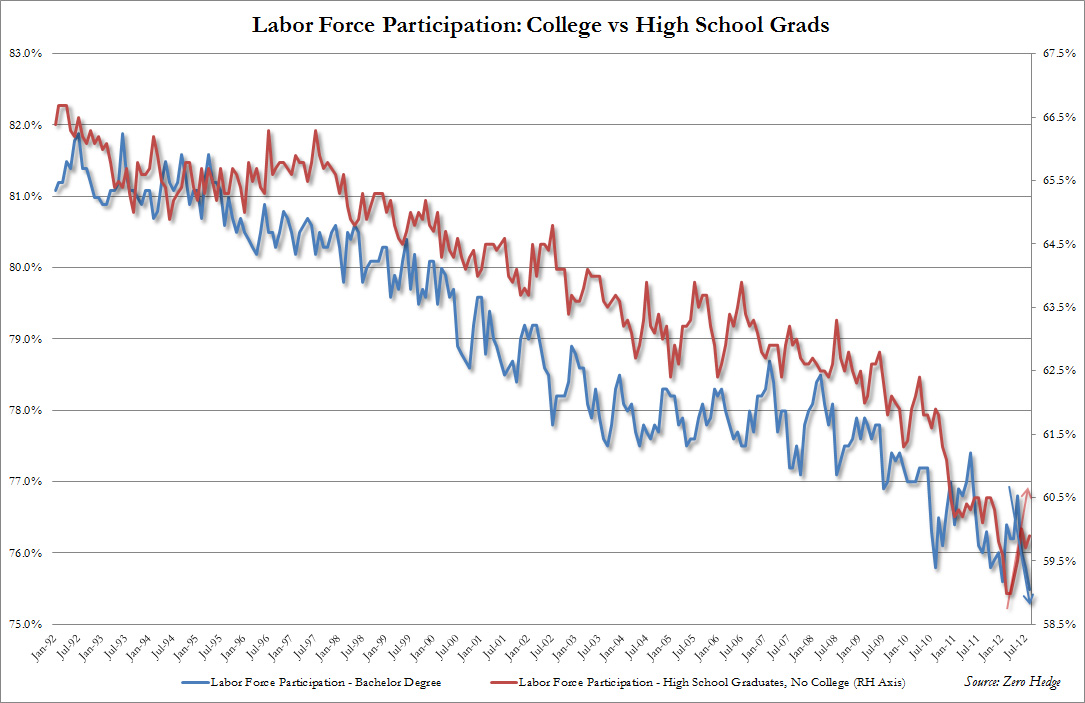

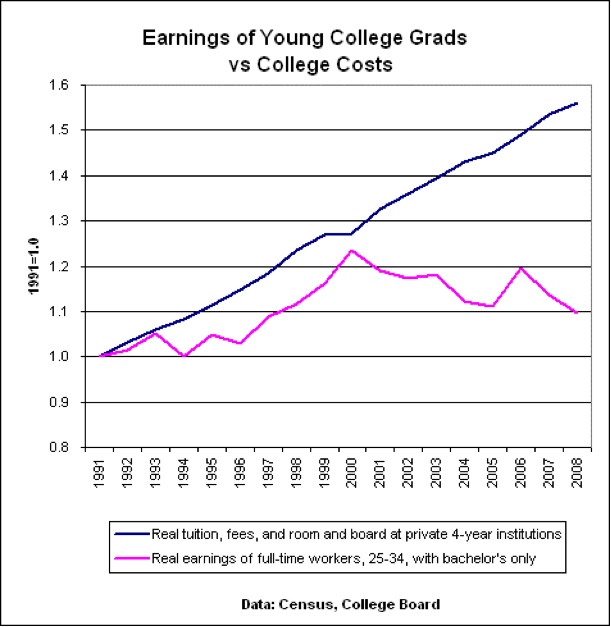

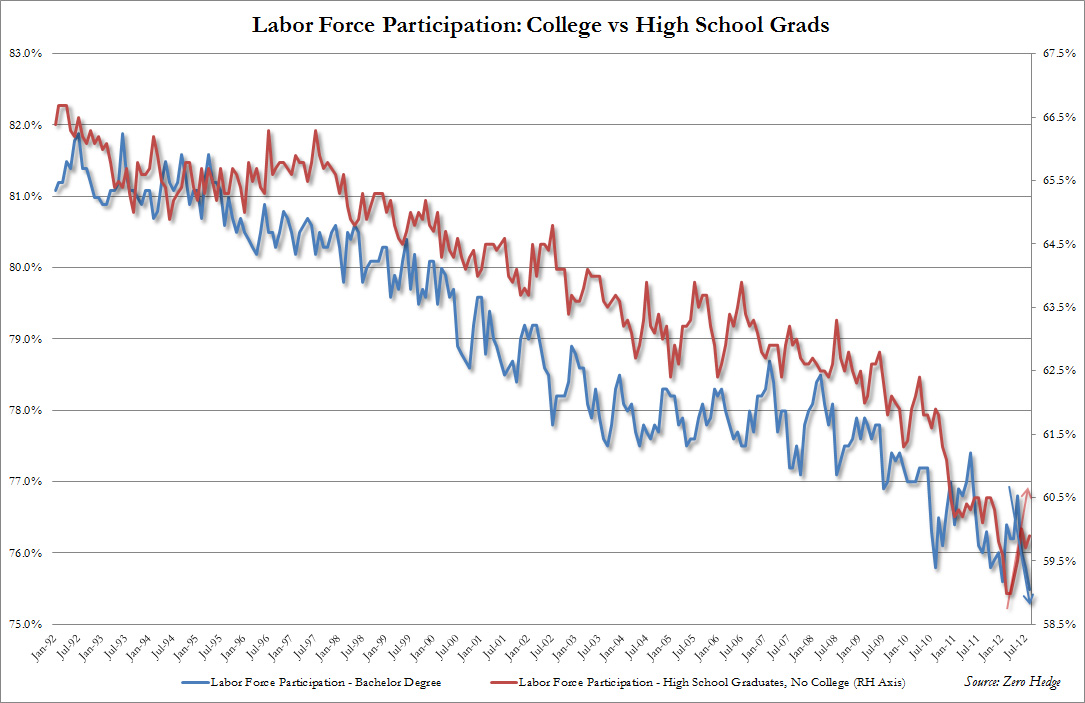

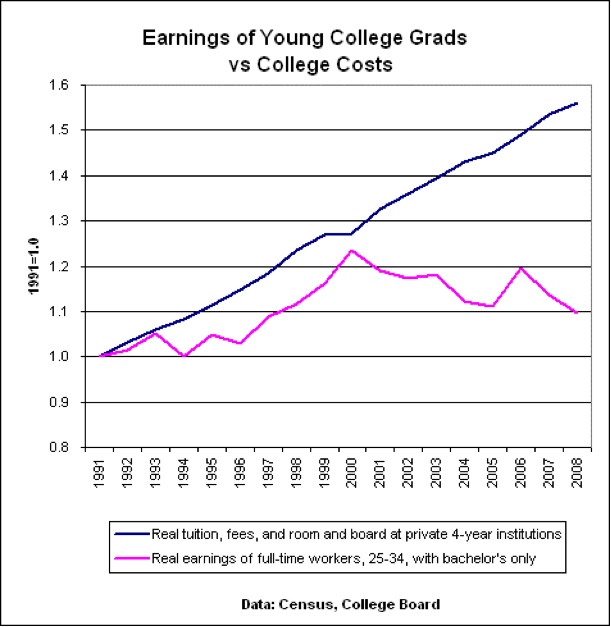

College just may not be that ticket to a better life.

We can't find the piece that defined the word young in this chart.

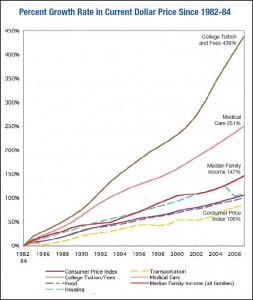

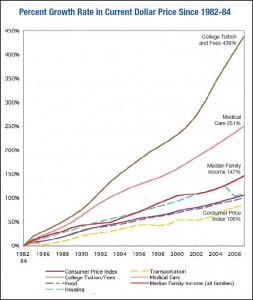

The most common complaint with regards to inflation ... at least among those that that we hear ... has to do with the increasing price of medical care.

The price inflation of a college education blows medical inflations's doors off.

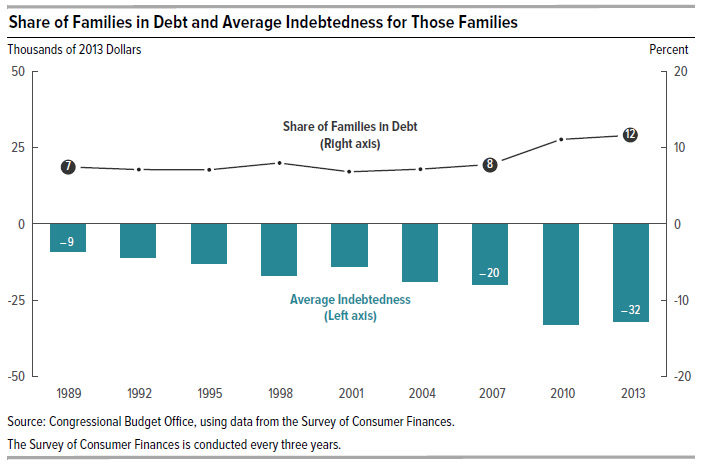

As a result, total student loans exceed credit card debt for the first time in history.

As an aside, student loans can't be extinguished in bankcruptcy since the Consumer Bankruptcy Reform Act of 1998.

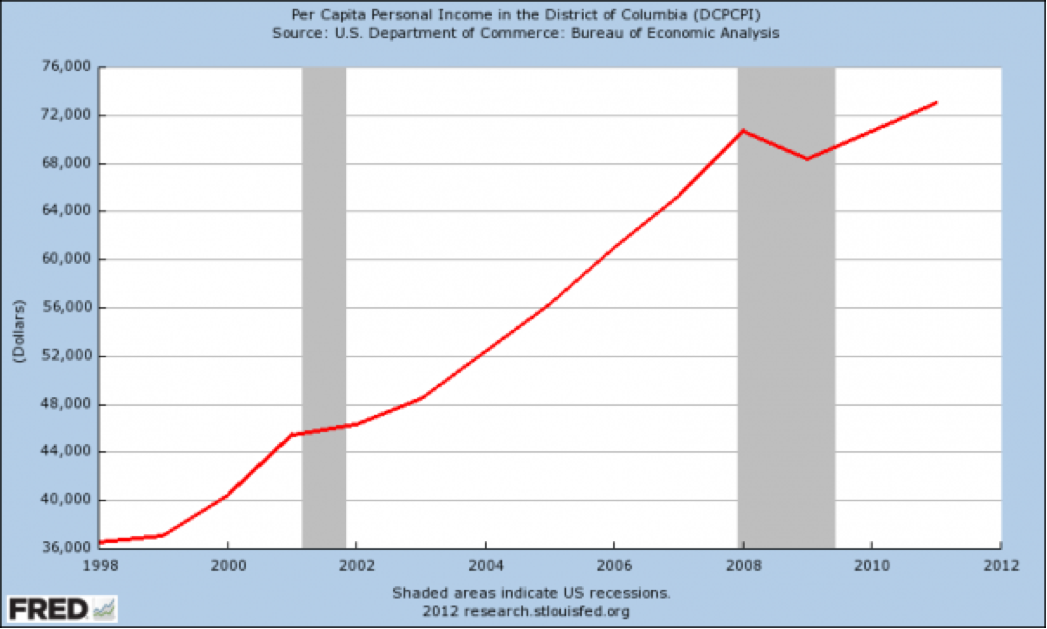

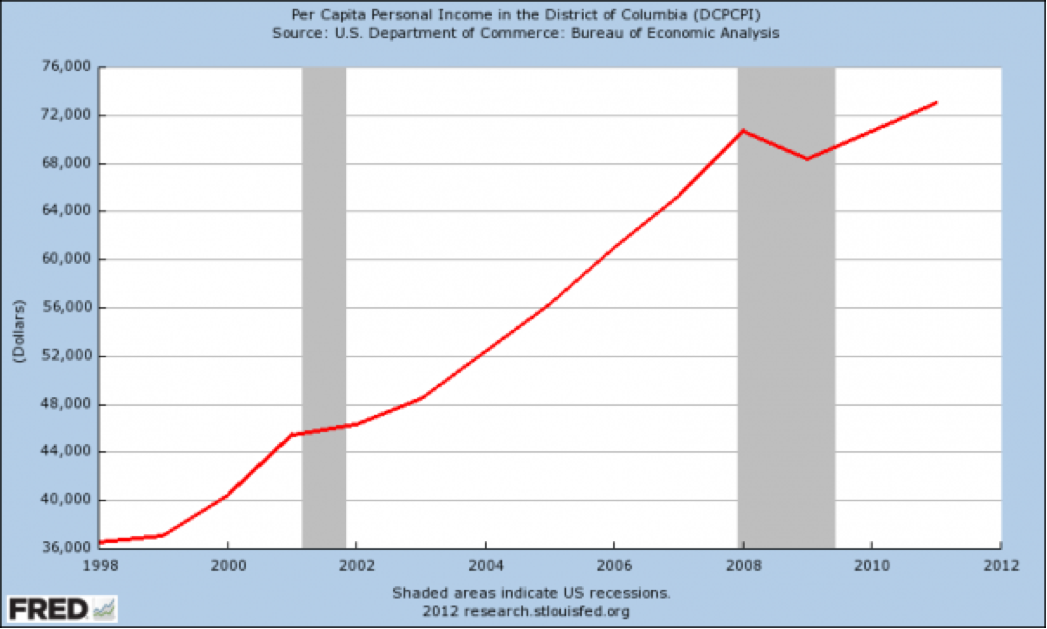

Not to worry, those scamps on Wall Street and in Washington are getting theirs.

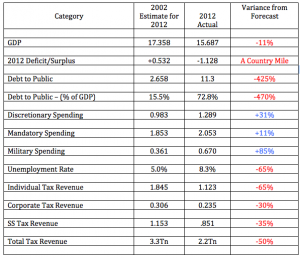

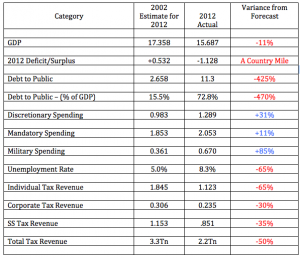

Speaking of Washington, the next time one of those highly paid professionals at the Congressional Budget Office whips out a projection in your vicinity, just reach out and slap that bastard.

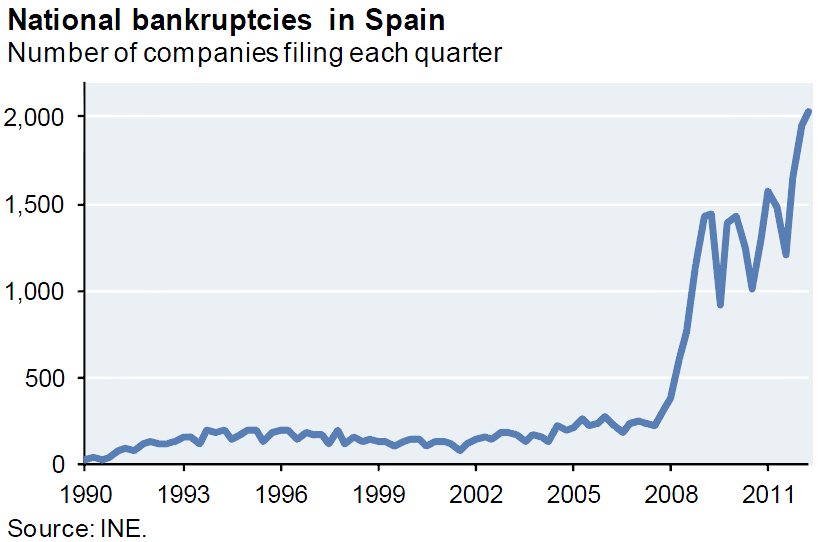

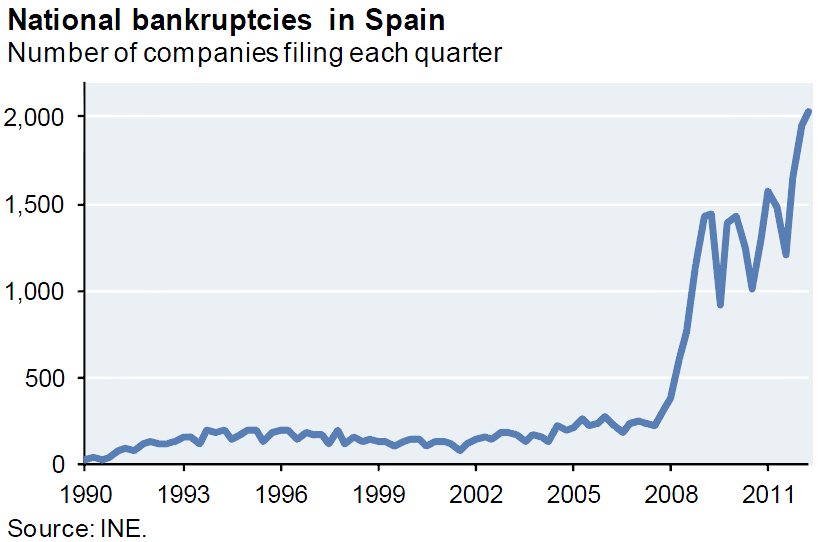

Speaking of bankruptcy.

Coming to a country near you?

Evidently the cartoonist here is not crazy about economist Paul Krugman.

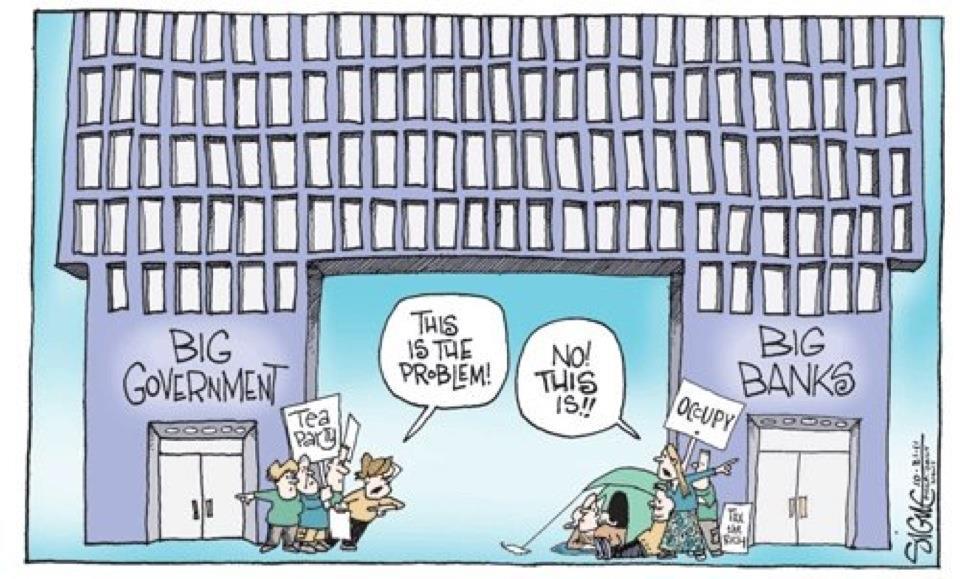

On a completely different subject, from  John Cole.

John Cole.

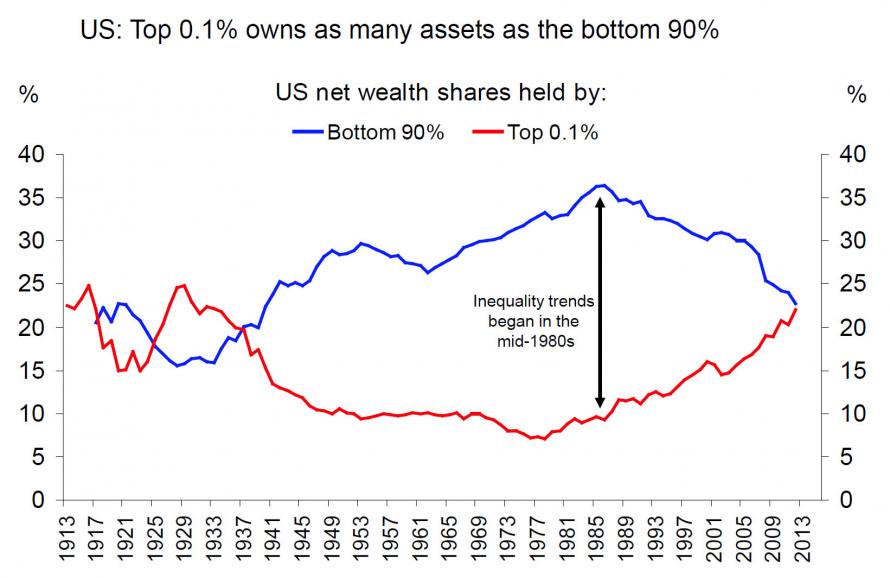

for the first quarter of 2018, the net worth of US households rose above $100 trillion for the first time ever, hitting a new all time high of $100.8 trillion.

for the first quarter of 2018, the net worth of US households rose above $100 trillion for the first time ever, hitting a new all time high of $100.8 trillion.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)