As previously disclosed, for many years, I've read people who have been reading Richard Russell for many years.

When what I should have been doing was reading Richard Russell.

Along with Harry Schultz and Joe Granville he clearly is one of the grand old men of the financial newsletter business.

Despite the fact that Mr. Russell is now 86 and significantly less hail than he used to be, I just dropped another $175 for a 6 month subscription to his newsletter, the Dow Theory Letter, despite the disclaimer at the bottom of the offering that reads something to the effect that, "You know Richard is 86 years old, Right? Ain't gonna be no refund.

If it goes just one week, it will have been cheap at twice the price.

The chart below is for DBC, the commodity tracking index offered on the New York Stock exchange.

Richard pulls out some of the items that make up that index immediately below.

Scoreboard year-to-date in percentages -- Agricultural

Cattle (lb)....................+12.0%

Coffee (lb)...................+36.9%

Corn (bu).....................+37.3%

Cotton (lb)...................+46.7%

Lumber(1000 bd.ft.)....+32.9%

Orange Juice (lb)..........+19.7%

Soy beans (bu)..............+13.2%

Wheat (bu)....................+29.8%

With the following commentary

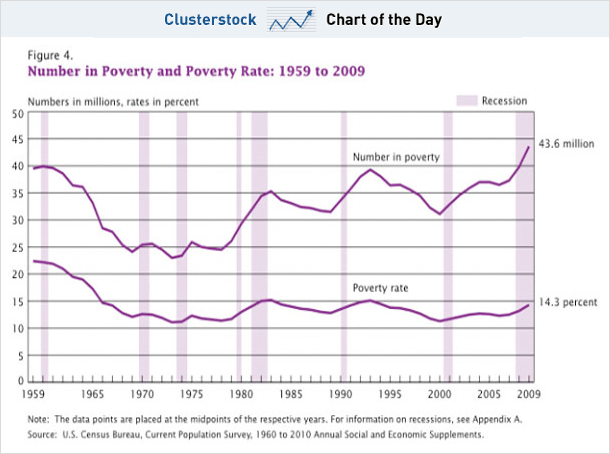

"Trouble -- The poverty sector and the middle class are having trouble enough, but the chart below spells more pain. This is the Commodity chart, and it's telling us that the price of food is heading skyward. With the price of food (corn, grains) heading higher and with oil now over 83, the squeeze is on for the majority of Americans.

The US is floating in liquidity. And nobody knows what to do with it. Which is one reason why stocks have been floating higher. Should you buy farm land, housing, commodities, silver, bonds, gold, insurance, what? There's no safe return on anything."

Here's Mr. Russell's latest writing on Gold.

Around 1999 and 2000 gold was selling at just above 260 an ounce. But more important, many well-known gold shares were selling like second-hand rain coats. These formerly much-loved gold shares were selling at such low or bargain prices that I thought one could buy thousands of shares and just "put 'em away" and forget about them. I knew gold wasn't going out of style, and it was just a matter of time before interest in gold returned, as it has in all history.

Great bull markets start with stocks selling "below known values." That's where gold mining shares were selling around 1999 and 2000. I equated gold shares in the year 2000 with the Dow in June 1999 at a time when the Dow was priced at 161. In the year 2000, I thought to myself, "Could this be the very beginning of a great bull market in gold, a bull market that could ultimately take gold above its January 1980 peak price of 850? That idea stuck in my head; in fact I became obsessed with the idea that a great bull market was beginning and very few people even suspected that was happening in gold.

Question -- OK, Russell, gold is now well above its peak price of 850 struck in 1980. So what do you expect next?

Answer -- I went through this same phenomenon in the 1960s with the stock market. We went through the correction of 1953, and we staggered through the vicious correction of 1957. In 1957 a severe recession enveloped the US economy, and almost everybody was convinced that the bull market that had started in 1949 had ended.

I learned from George Schaefer that big bull markets almost always end with a speculative explosion. We had not seen that kind of action in the bull market that started in June, 1949. I was convinced that a speculative third phase of the bull market lay somewhere ahead. For that reason I was convinced that the bull market was not over.

In fact, I was so sure of my stand that I wrote an article that was published in Barron's (December, 1958) in which I made the case for a coming final boom phase in the stock market. That article drew a great amount of interest, and it put me in business. A speculative third phase did appear in the stock market during 1956 through the early '60s.

Today I am taking the same stand regarding the gold bull market. The gold bull market will not end with a fizzle and a whimper. It will end with intense speculation and widespread interest from the funds and the public. We haven't seen that kind of activity yet, but I'm convinced that a period of wild speculation in gold lies somewhere ahead.

This is why I continue to beg my subscribers to load up with gold. As I see it, we are nearing a period of intense speculation that will be beyond anything seen before by the last three generations of Americans. Ironically, more money made in the final explosion in gold than was made during the first two phases combined.

Great bull market are seen maybe once or twice in a lifetime. The current "stealth" gold bull market has sneaked up on most Americans. The very phrase, "gold bull market" is sneered at by most analysts today. In fact, most of the comments on gold today come in the form of warnings; "Gold is too high." "Gold is in a bubble." "Gold will sink back below 1000." "Gold is a fool's play."

Nonsense. Gold is moving ever-closer to it's climactic speculative third phase. The negative comments about gold will only serve to make the gold bull market that much stronger. In this business, there is nothing more powerful than a primary bull market that has been denigrated, spat at, and held back for years.

And that's the end of my "lecture" about the fabulous gold bull market.

Below, the profile of one of history's greatest primary bull markets (and it's not finished yet).

Either chart will link you up to Richard Russell's fine site.

Super duper way double highly recommended ......... with the previously discussed caveat.

![]() Associated Press interactive titled "Dropout Factories".

Associated Press interactive titled "Dropout Factories".

.jpg)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)