World Military Spending

From The Stockholm International Peace Research Institute![]() .

.

As always, click on the graph below for the entire press release which contains links to the paper.

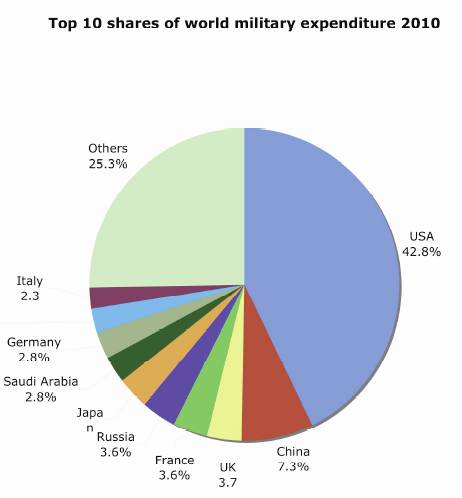

World military expenditure in 2010 is estimated to have been $1630 billion, an increase of 1.3 per cent in real terms.* The region with the largest increase in military spending was South America, with a 5.8 per cent increase, reaching a total of $63.3 billion, according to new data published today by Stockholm International Peace Research Institute (SIPRI)

The United States still exceptional in military spending

Although the rate of increase in US military spending slowed in 2010—to 2.8 per cent compared to an annual average increase of 7.4 per cent between 2001 and 2009, the global increase in 2010 is almost entirely down to the United States, which accounted for $19.6 billion of the $20.6 billion global increase.

‘The USA has increased its military spending by 81 per cent since 2001, and now accounts for 43 per cent of the global total, six times its nearest rival China. At 4.8 per cent of GDP, US military spending in 2010 represents the largest economic burden outside the Middle East’, states Dr Sam Perlo-Freeman, Head of the SIPRI Military Expenditure Project.

- Read more about World Military Spending

- Log in or register to post comments

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)