First from Physician's Committee for Responsible Medicine via

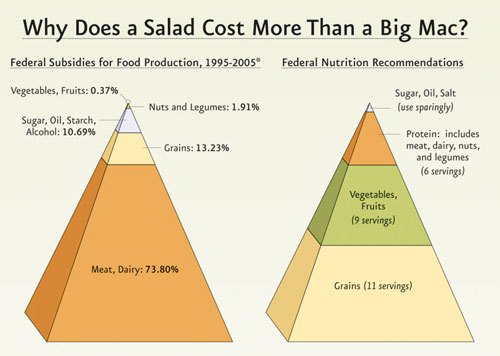

via  Chart Porn via Katie (who is now somebody's Grandma) a side by side comparison of Federal Subsidies for Food Production and Federal Nutrition Recommendations, niether of which would exist at all were it up us.

Chart Porn via Katie (who is now somebody's Grandma) a side by side comparison of Federal Subsidies for Food Production and Federal Nutrition Recommendations, niether of which would exist at all were it up us.

This is followed up by a three para story on how U.S. government food policy became as screwed up as U.S. government everything else.

I'll sum up ...... politics as usual.

You should read it anyway.

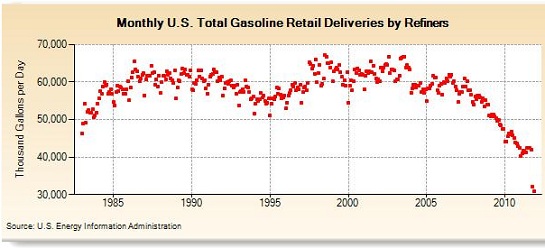

Next from Zero Hedge via the

via the  U.S. Energy Information Administration which also would not exist were it up to us.

U.S. Energy Information Administration which also would not exist were it up to us.

I'm feeling charitable this morning and feel like you need to gain the conclusion drawn within this article so I've cut and pasted it below.

There are no data-supported broad-based drivers for dramatically lower gasoline consumption other than austerity and lower economic activity.

The code-word for "austerity and lower economic activity" that is verboten in the Mainstream Media is "recession." Indeed, if you examine the EIA data, the only causal factor that has backing in the data is recession--or if you prefer, austerity and lower economic activity.

Then there is the price of fuel.

People have to go to work, pick up the kids, get their meds, etc., and few urban centers in the U.S. have mass transit systems that are up to the task of replacing autos. So most Americans have what we might call non-discretionary driving. But as the price of fuel rises, people find ways to lower their discretionary driving by combining trips, shopping less often, shortening or eliminating vacations, etc. Enterprises reduce costly business travel with teleconferences and other digital technologies.

Data supports the notion that high oil prices lead to recession.

For example, Chris Martenson recently made a compelling case for this in Why Our Currency Will Fail ("Note that all of the six prior recessions were preceded by a spike in oil prices.")

Household income doesn't rise just because oil is climbing in cost, and so the extra money spent on fuel is diverted from other consumption or saving (capital accumulation). Higher fuel costs lower household capital formation and reduce consumption/economic activity.

Oil has been elevated for months, kissing $100 and rarely dipping below $90/barrel. Do higher oil costs explain the decline in gasoline consumption? Once again, they undoubtedly influence consumption, but that cannot explain the 40% drop in consumption. After all, when oil spiked in 2008 to $140/barrel, deliveries only dropped by a few million gallons: from 58.8 MGD in July 2007, before the spike, to 54.8 MGD at the point of maximum pain in July 2008.

The cost of oil has declined sharply from mid-2008, yet consumption has tanked from 54.8 MGD in July 2008 to 42.4 MGD in July 2011. That's a hefty 21% decline.

What other plausible explanation is there for the decline from 42.4 MGD in July 2011 to 30.9 MGD in November 2011 other than a dramatic decline in discretionary driving?

That 27% drop in a few months in unprecedented, except in times of war or sharp economic contraction, i.e. recession.

If we stipulate that vehicles and fuel consumption are essential proxies for the U.S. economy, then we can expect a steep decline in economic activity to register in other metrics within the next few months.

Such a sharp drop would of course be "unexpected" given the positive employment data of the past few months. But as the data above shows, employment isn't tightly correlated to gasoline consumption: gasoline consumption reflects recession and growth.

In other words, look out below.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)