First of all, apologies to whomever put together the below chart.

I grabbed it off from somewhere thinking that there was some identification on the chart to acknowledge and link to.

There is not.

Now I can't remember where I found it.

If somebody has seen it before, let me know.

I will cheerfully give credit and link to the source.

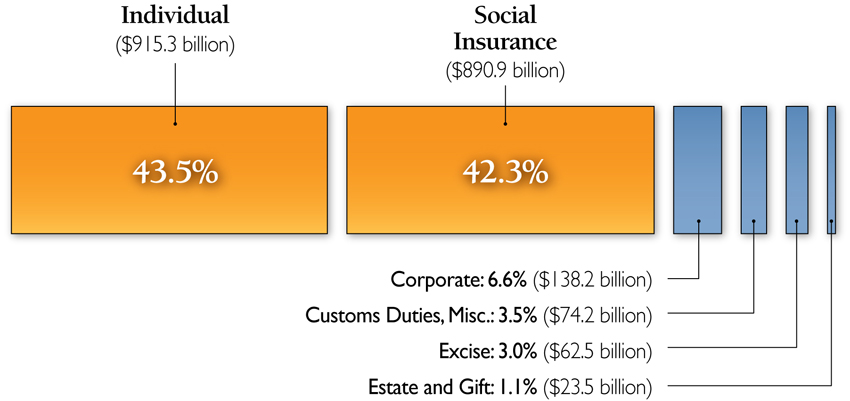

The following chart provides an outstanding example of how our government keeps us apart and at each other's throats.

Anybody paying the slightest bit of attention has heard that the rich pay the lion's share of the INCOME TAXES in this country.

It is true.

The top 1% of taxpayers pay about 35% of our nations INCOME TAX.

The top 25% pays about 83%.

The top 50% pays about 96%.

It is also true, the rich earn the lion's share of our national income, but on a percentage basis they pay more in taxes than they earn in income.

But INCOME TAXES on individuals only makes up 43.5% of the total tax receipts of the federal government.

42.3% is paid in in the form of "PAYROLL TAXES" aka "WITHHOLDING TAXES" aka FICA, aka Social Security and Medicare taxes which are deducted directly from wage earners paychecks and are sent to the government.

The balance mostly comes from by corporate taxes which we all pay when using the goods or services provided by corporations, and some other relatively minor sources.

The withholding rate for "The Old Age and Survivors Insurance Trust Fund (OASI), again what most of us call Social Security or FICA is 12.4% of one's taxable income.

The rate for Medicare is 2.9% of one's taxable income.

For a total of 15.3% tax on wage earners above the INCOME TAX.

In the case of Social Security, the tax is largely paid by middle and lower income taxpayers because the income against which it is applied is capped at $106,800.

Here's where the truth gets bent.

I'm trying to put the best construction on this.

You are told that the funds go to the "Social Security Trust Fund" or the "Medicare Trust Fund".

And that's true as far as it goes, but what really happens is that the Federal Government issues debt (bonds) which is exchanged for your (cash) payroll taxes.

And subsequently sends your payroll taxes (cash) to the general fund.

Every dime of income the Government collects regardless of source, ends up in the general fund where it is spent as though it were exactly the same thing as "INCOME TAXES".

Name an activity that the Federal Government participates in, and that is where your FICA is being spent.

Wars in Afghanistan, Iraq, now Libya, maybe Iran.

Defending Europe (NATO) from Russia, or Japan, Australia, New Zealand and Taiwan and South Korea from North Korea and China, the Saudis from Iran.

Not to mention from their own people.

Welfare benefits, unemployment compensation, food stamps.

Government salaries, pensions, benefits and perks.

National parks, roads, bridges, education, research.

Office supplies.

Now, some of that stuff you can legitimately call an investment in America.

But is it appropriate to be investing people's health and retirement monies on all of the above?

Here's the government's argument,

"Some people are not able, or prepared to invest their retirement money themselves. What if they make bad investment decisions and lose their money?

Were some people in control of their retirement funds they would indeed make some bad investments and suffer losses.

But just for fun, imagine a prospectus selling an investment in the defense of Europe.

Here's the offering.

You provide military equipment and personel to Europe free of charge, and in so doing allow the average European citizen a month of vacation every year, mostly free health care, and retirement at around age 58.

You don't get a plug nickel back, get to work until your 61.5 at least, but ................. you get to say that you're making the world safe for Democracy.

You can be a drooling moron and you're still passing on that opportunity.

So, here's the consequences:

Upper income people feel abused because they're thinking they're doing all the heavy lifting.

The middle class feels abused because they thought they were saving for their retirement, but are starting to realize that Social Security is likely to go broke, their money having been squandered.

In truth, it ain't gonna go broke.

The government will print the dollars to pay you back.

The bad news is that each dollar is likely to be worth a helluva lot less than the one you payed in.

Retirement money is just being spent and not invested, which results in the poor feeling abused because there are no jobs, and subsequently no future.

While all they hear is "The Rich" bitching about their taxes.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)